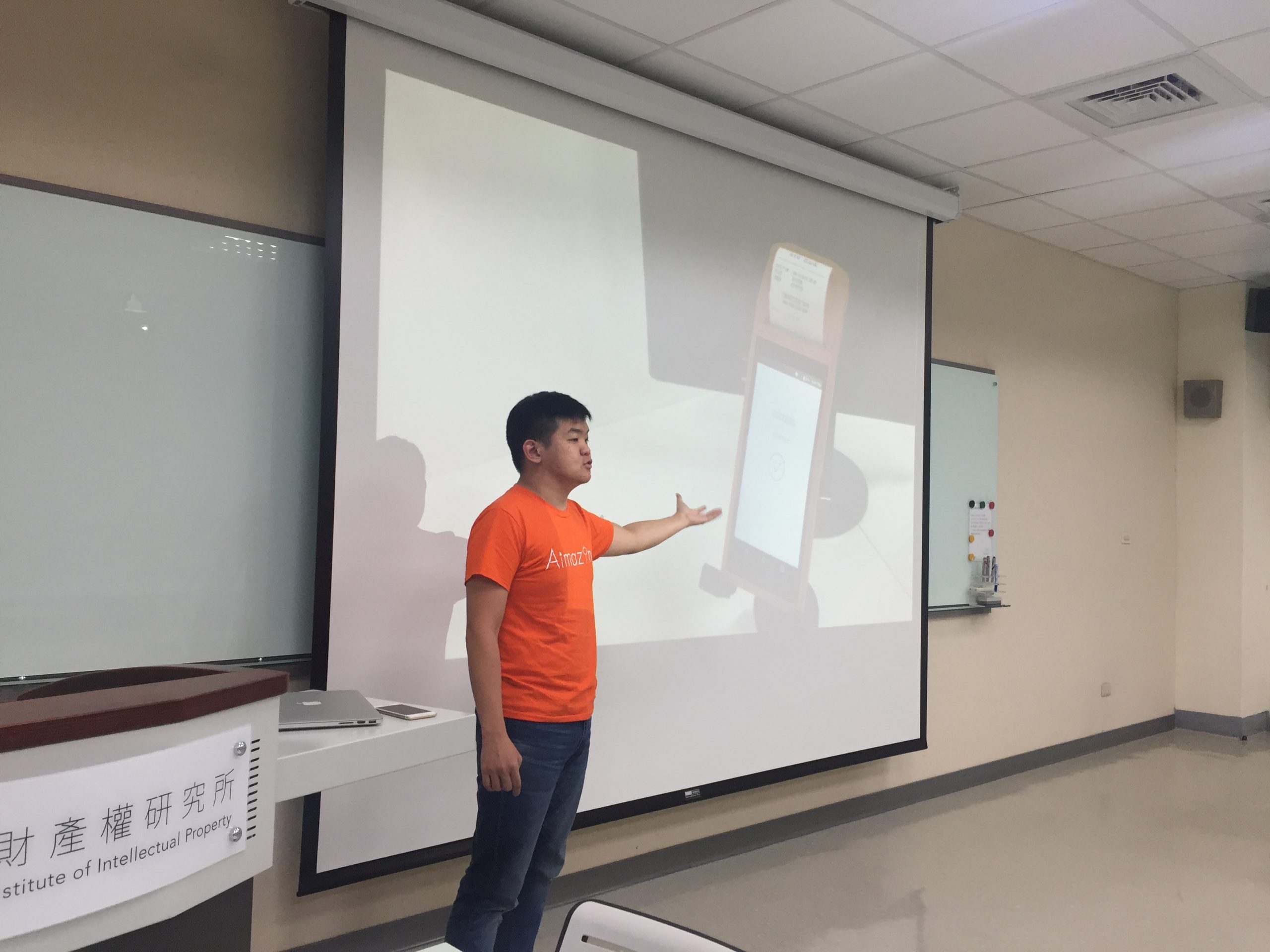

On August, 21th 2018, STARTBOARD participated in Mox Demo Day, where 6 startup teams full of brilliant ideas pitch their products to senior investors.

Founded by SOS Venture and Gmobi, Mox made its debut in December, 2015. As its name discloses, Mox is also known as Mobile Only Accelerator, making 24/7 dedication to nurture global startup teams in such fields as application, mobile services and online platform. Mox provide startups with top-notch mentors and resources with an eye to refining startup teams’ business models and eventually nailing it at emerging markets.’

Starting up is about creating a whole new business model that is innovative enough to disrupt the ecosystem; not about maximizing your income by adhering to old patterns.

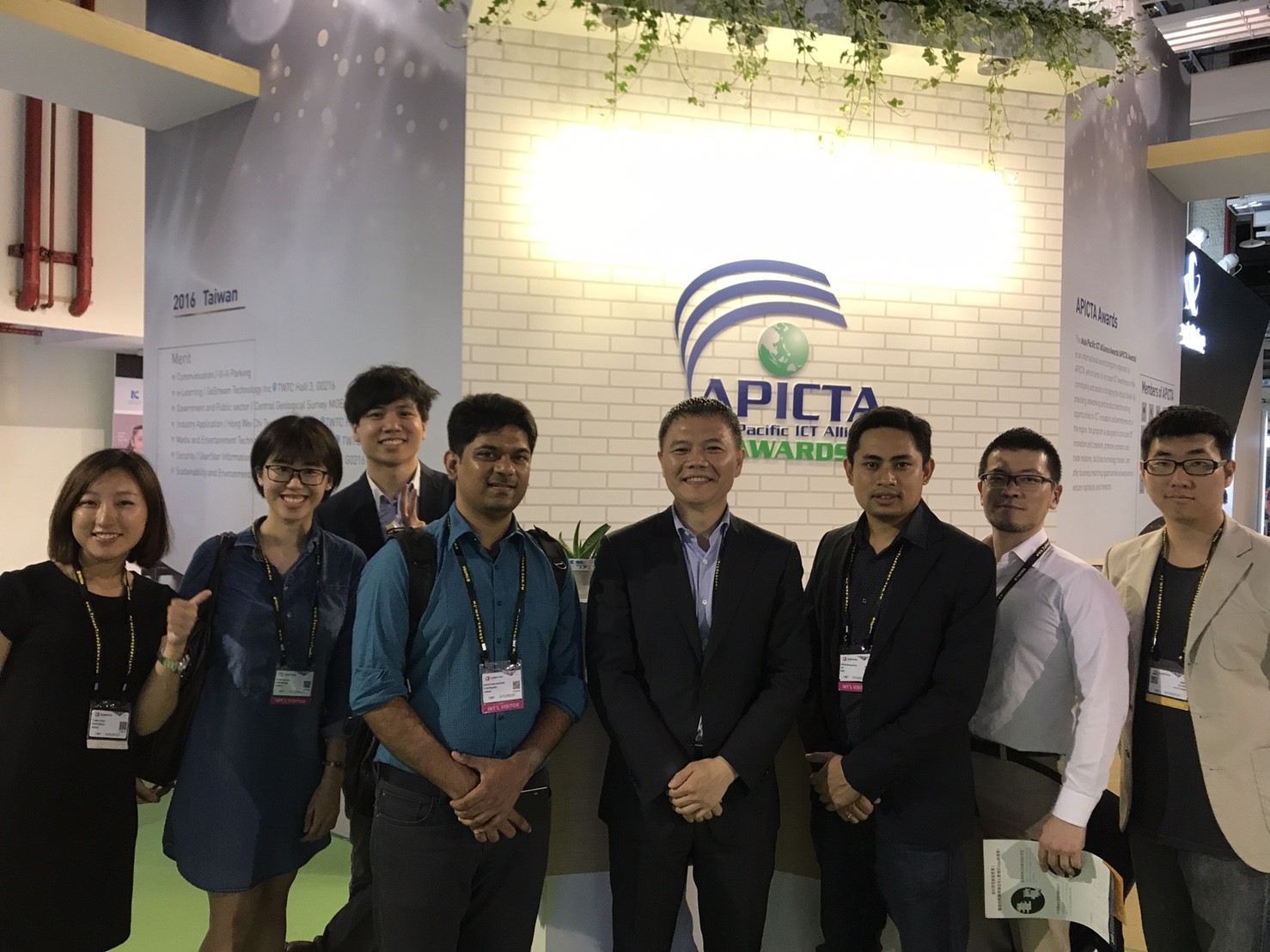

Mox provides startup teams with opportunities to pitch themselves in front of the general public, government agencies and investors with laser-like perception.At Mox Demo Day, STARTBOARD also met up with six startups with promising future, seeking further possibilities of cooperation with big corporation and investors. The first startup team we desire to highlight is ClearDekho from India.

ClearDhkho is the first of such online prescription glasses business in India!Harnessing their keen observation well, ClearDhkho realizes that in India, more than 250 million people dwelling in remote areas and little towns get daily struggles to “see clearly.” On top of hectic traffic and the long distance they need to travel through, some prices of eyewear products exceed the reasonable price they set.

ClearDhkho also regards itself as Warby Parker for the India mass market, allowing target audience to purchase glasses with simply a few clicks at 7 US dollars. Aside from perks of saving your time and money, the good news is that ships and returns are all for free! Setting their sights on achieving 75% of the Indian population, ClearDhkho continues to expand the business, opening six to seven stores in India on a monthly basis!