Taipei City hosted a two-day event for startups from around the world to gather and promote their ideas. The IDEAS Show took place in Taipei city on July 25 and 26. The show brought with it multiple startups based from all around the globe. The event was a two-day event held at the National Taiwan University Hospital International Convention Center (台北大醫院國際會議中心).

The Ideas Show is an annual contest where multiple startups from around the world gather together and pitch their business models and ideas to the judges in an attempt to win the contest.

The show is an initiative by the Ministry of Economic Affairs to boost startups in Taiwan as well as the country’s economy.

The event celebrated its 10th anniversary this year with a total of more than 17,400 participants over the years, of whom 418 came from foreign countries and 301 from local and international teams pitching their ideas or designs for the contest. The show has been considered as a massive success.

This year’s event saw multiple startups from US, Europe, and South East Asian countries. Each startup brought in a unique idea and concept.

From virtual poultry farms to 3D screens on your iPhones, and tech startup incubators to VR, this year’s show featured a large pool of talents from around the globe.

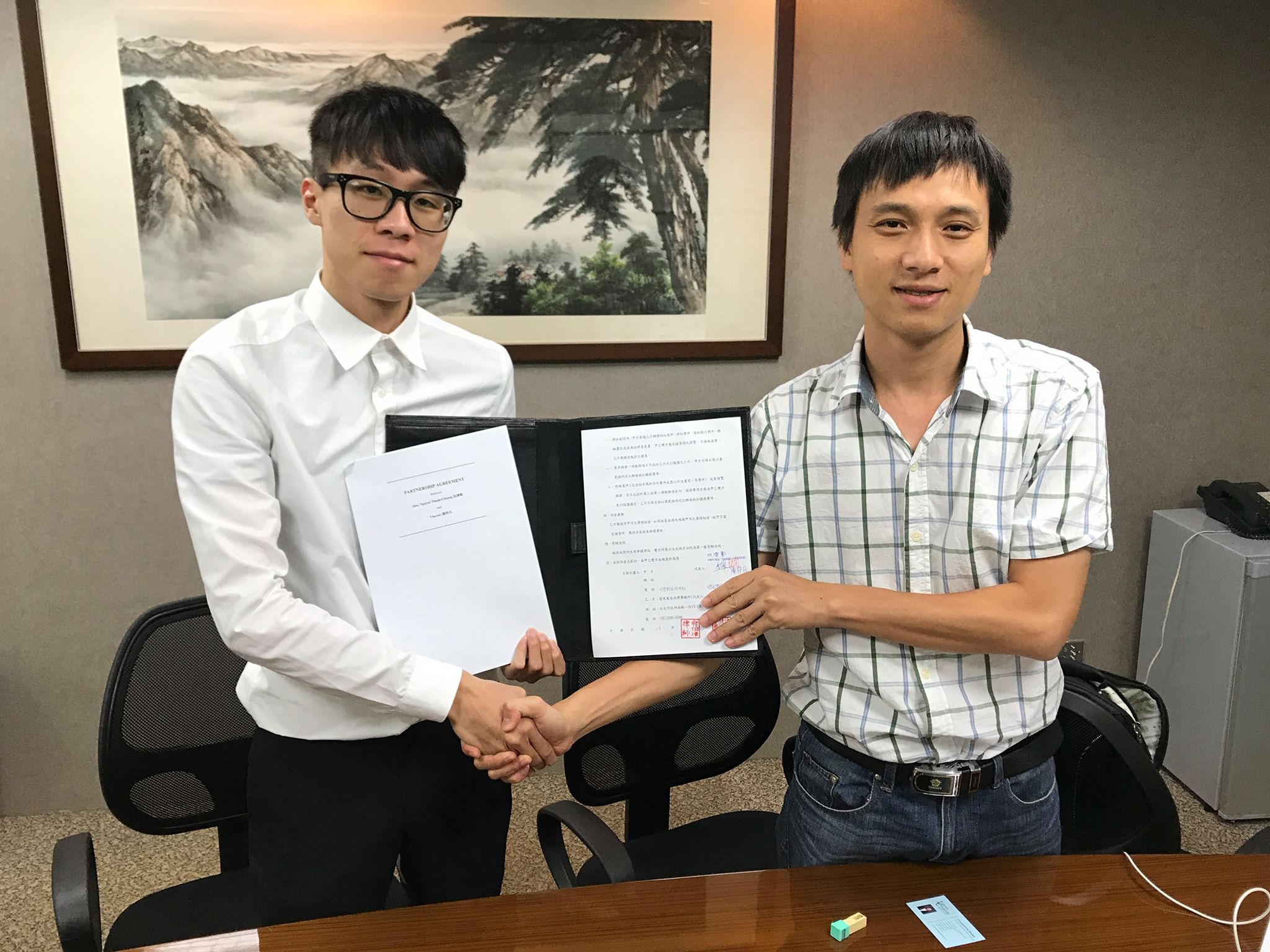

STARTBOARD was excited to be a part of such a great event and also feels much honored to have met such interesting and great entrepreneurs from different parts of the world.

STARTBOARD is happy to have made some new friends in the industry and also was there to support our team Vnimation who were pitching for the first time in a platform like the IDEAS show to the judges. Our team also won an award and we are so proud and happy & would like to congratulate them for their achievement.

STARTBOARD had an amazing experience in the event which was hosted and carried out so gracefully and we had such an amazing time with our staff members and friends. STARTBOARD would like to thank each and every one of you who took the time out and visited our booth. We are grateful for your love and support.